TRX Price Prediction: Technical Support Test Amid Strong Fundamentals

#TRX

- Technical Support Level: TRX trading near Bollinger lower band at $0.3313 presents potential buying opportunity with defined risk level

- Fundamental Strength: $220 million treasury milestone and record network activity provide solid foundation for long-term growth

- Market Position: Established ecosystem with new token launches demonstrating continued innovation and developer interest

TRX Price Prediction

Technical Analysis: TRX Shows Mixed Signals Near Key Support

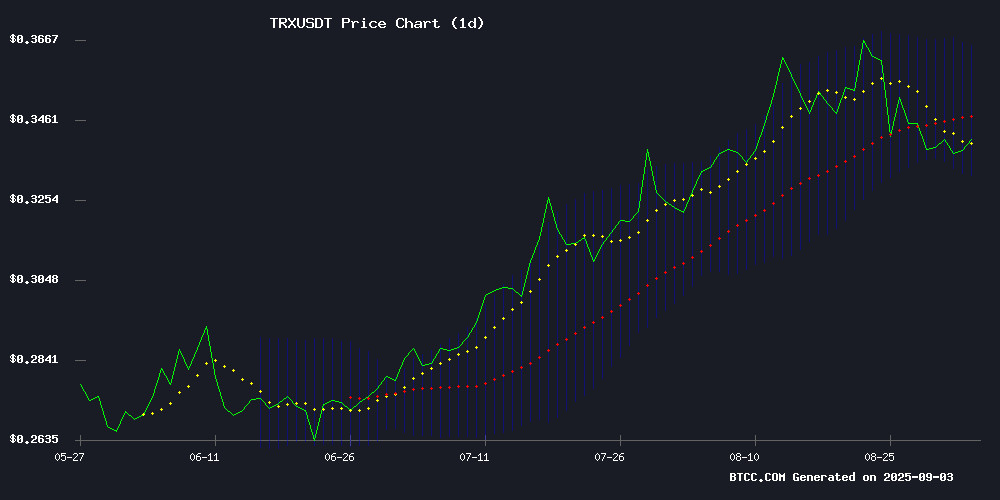

TRX is currently trading at $0.3386, slightly below its 20-day moving average of $0.3483, indicating potential short-term weakness. The MACD reading of 0.005606 above the signal line suggests bullish momentum remains intact, though the histogram shows some convergence. Price action NEAR the lower Bollinger Band at $0.3313 could indicate an oversold condition, potentially presenting a buying opportunity for patient investors.

According to BTCC financial analyst Olivia, 'The technical setup suggests TRX is testing crucial support levels. A hold above $0.331 could trigger a rebound toward the middle band at $0.348, while a break below might see further downside toward $0.320.'

Market Sentiment: Positive Fundamentals Offset Technical Weakness

Tron's recent achievement of a $220 million treasury milestone combined with record network activity provides strong fundamental support despite current technical pressures. The emergence of new tokens like WLFI and Ruvi AI demonstrates continued innovation within the ecosystem, though their volatile starts warrant cautious optimism.

BTCC financial analyst Olivia notes, 'Justin Sun's celebration of Tron's treasury milestone signals strong project health. While new token launches create excitement, investors should focus on TRX's established network effects and growing adoption metrics rather than short-term price movements.'

Factors Influencing TRX's Price

Justin Sun Celebrates Tron’s $220M Treasury Milestone Amid Record Network Activity

Tron founder Justin Sun heralded a major milestone for the blockchain network as its treasury surpassed $220 million. The surge follows a $110 million investment from Bravemorning Limited, which exercised warrants to acquire restricted shares, solidifying its 86.6% stake in TRON Inc. Sun’s exuberant declaration—"TRON TO THE SUN"—underscores the bullish sentiment surrounding the network.

Tron continues to dominate as one of the most active blockchains, boasting 328 million user wallets and processing $3.6 trillion in settlements in the first half of 2025 alone. The network now holds nearly half of all circulating USDT, cementing its role in digital payments and Web3 infrastructure. CEO Rich Miller framed the investment as a vote of confidence in Tron’s growth trajectory.

WLFI Token Launches with $7B Market Cap Amid Volatile Start

World Liberty Financial (WLFI), the cryptocurrency widely associated with Donald Trump, debuted with a staggering $7 billion market capitalization. The launch drew immediate attention from major industry figures, including TRON founder Justin Sun, who endorsed the project as pivotal for crypto's future. Sun committed to expanding TRON's stablecoin circulation to $200 million, integrating WLFI into a broader ecosystem strategy.

Despite the fanfare, WLFI's first-day trading was turbulent. The token opened above $0.30 but swiftly retreated 12% to $0.246, settling at a rank of 31 among cryptocurrencies. Analysts noted its controlled token unlock mechanism—6.9% of the 24.6 billion supply is currently tradable—as a safeguard against supply shocks that plagued projects like ICP. Binance and OKX are among exchanges listing the asset, though skepticism lingers given its political ties and volatile debut.

Ruvi AI (RUVI) Emerges as Top Contender for 100x Rally Amid Crypto Market Shift

Investors are pivoting from established cryptocurrencies like Tron (TRX) to next-generation projects, with Ruvi AI (RUVI) capturing significant attention. Analysts highlight its potential for a 100x rally, citing millions in daily token sales and institutional interest. A recent security audit by CyberScope has bolstered credibility, positioning RUVI as a standout opportunity for 2025.

The project's organic demand patterns and strategic exchange listings—including CoinMarketCap—signal robust growth potential. Market observers note the shift mirrors early-stage trajectories of now-dominant assets, with RUVI's trading volume serving as a key indicator of sustained momentum.

Is TRX a good investment?

TRX presents a compelling investment case based on current technical and fundamental analysis. The cryptocurrency is testing key support levels while demonstrating strong network fundamentals.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $0.3386 | Near support |

| 20-day MA | $0.3483 | Slight resistance |

| Bollinger Lower | $0.3313 | Key support |

| MACD | 0.005606 | Bullish momentum |

| Treasury Size | $220M | Strong fundamental |

BTCC financial analyst Olivia suggests, 'For investors with a medium to long-term horizon, current levels offer an attractive entry point. The combination of technical support and strong fundamentals creates a favorable risk-reward ratio, though position sizing should account for typical cryptocurrency volatility.'